“Soda is liquid Satan,” proclaimed the blurb of a rather tatty old book I came across recently. The name of this book falls solidly in the NSFW category but all you need to know is that it’s a sort of self-help/diet manual for “all women who want to be thin”…

Fizzy drinks go flat

We may have moved on from obsessing (too much) over being thin since 2005 when the said book was first published, but that line has pretty much captured the essence of current public opinion towards carbonated soft drinks (CSDs).

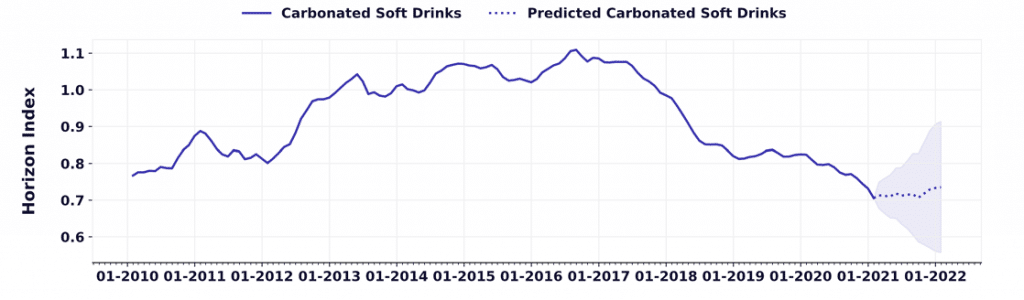

Spoonshot’s data shows that interest in the category has been on the decline since 2017 due to concerns over the high sugar content in the drinks. Volume sales for the category have also been tumbling for well over a decade as consumers switch to hydration options they perceive to be healthier, including juice, tea, coffee, and flavored water.

Interest in CSDs has declined by 34% since 2017

Limited innovation

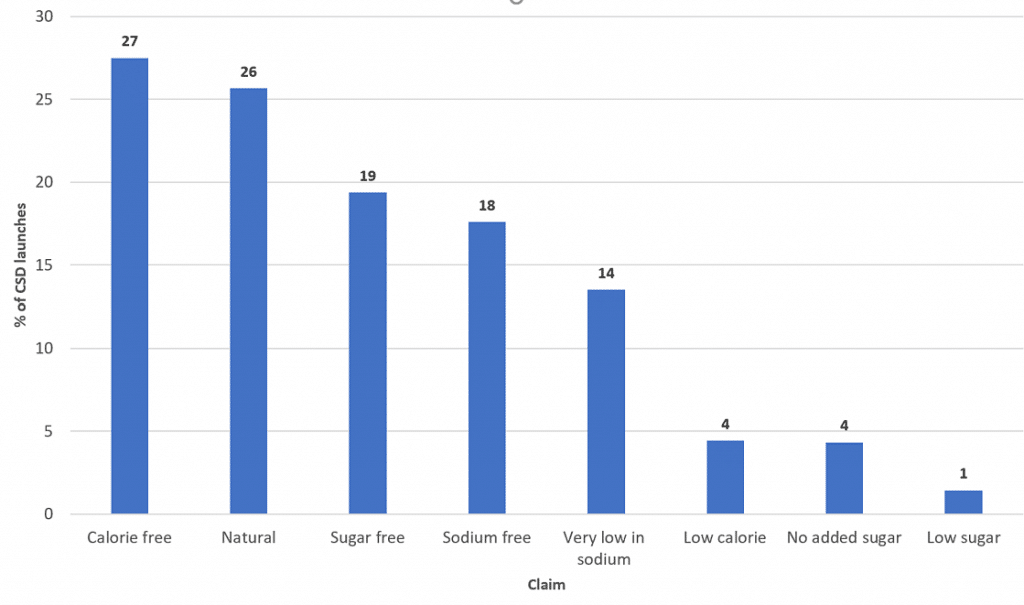

Part of the issue is that innovation in the CSD space that can be considered healthy or better-for-you has been limited to taking away rather than adding in. So, low-cal or low-sugar claims have become pretty standard – 1 in 5 launches are sugar-free – but added nutrition has not. There are very few CSD products with fiber and practically none with protein, even though these have been attempted in the past. Just 1% of products called out Vitamin C.

Log in to Spoonshot to see what other claims are made by CSDs.

Share (%) of select better-for-you claims within CSD launches

Another way that CSD companies have addressed declining sales is by pivoting to sparkling or flavored water – or by innovating in other categories altogether. This has immensely benefited the flavored water category, but it has hobbled growth for traditional soda pop.

It’s time for functional soda

While low-sugar and low-calorie claims are important to consumers and to the overall CSD category, there’s no denying that innovation in this space has been slow. But it’s not been non-existent. A few startups have recognized that CSDs need a bit of an image overhaul and appear to be taking cues from other indulgence categories, who have responded to similar criticism in a number of ways, including:

- Adding macronutrients, like protein and fiber

- Adding micronutrients, like vitamins and minerals

- Replacing base ingredients with more nutritious ingredients

- Cutting down on sugar and salt

- Reducing portion size

- Getting rid of artificial additives of all sorts, and so on.

These steps have benefited categories like baked goods and salty snacks as well as juices. So there’s no reason why it would not work for CSDs if taste, texture, and functional benefits are in line with consumer demand. It’s in fact high time that functional soda broke onto the scene.

Also Read: Food Trend Predictions for 2022

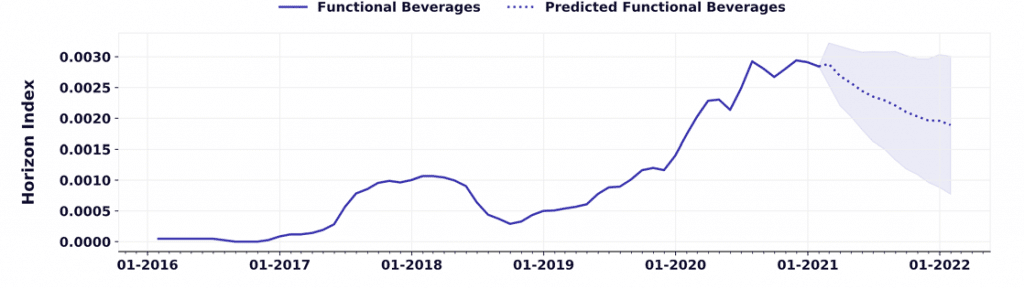

Here are a few companies that have gotten this right, especially since interest in functional beverages is on the rise.

Consumer interest in functional beverages grew by 41% over the last year

Olipop

Functional benefit: Digestive health

Base: Carbonated water, fruit juice, natural flavors

This functional soda brand launched in late 2018 and has seen significant growth since. The Olipop highlights digestive health support, with prebiotics and a third of the daily fiber requirement (9g). It has just 2-5 grams of sugar per can as well as low-cal and low-carb callouts.

In addition, the range has been formulated with a number of different botanicals, including marshmallow root, ginger, slippery elm bark, nopal cactus, Jerusalem artichoke, cassava root, kudzu root, and others. Olipop says that these botanicals have been included for their health benefits based on research. The company also said that sales of the brand grew 900% during 2020 and internal revenue forecasts exceeded expectations by about 30%.

Poppi Prebiotic Soda

Functional benefits: Aids digestion, boost immunity, supports glowing skin, relieves bloating

Base: Apple cider vinegar, fruit juice, sparkling water

This range got its first break on Shark Tank and is an interesting case study on the importance of branding. It was initially called Mother (presumably an homage to its ACV roots) and promoted its hero ingredient front and center, but this turned out to be quite polarizing for consumers. It was eventually rebranded as a “sparkling prebiotic soda” in colorful cans. These drinks are also low calorie and low sugar, with natural flavors and stevia. The company says that it is seeing strong triple-digit growth as a result of its increased distribution.

Koios and Fit Soda

Both brands of functional sodas are from Koios Beverage Corp, a company that focuses on nootropics. The brands are doing well enough that

Koios

Functional benefits: brain health, energy

Base: Sparkling water, green tea extract, lion’s mane mushroom

Koios is an extension of the company’s supplements business and it includes nootropic and adaptogenic ingredients to improve cognitive health. The range includes vitamins, electrolytes, medium-chain triglycerides from coconut oil, L-theanine, L-tyrosine, and ginseng. This puts the brand straddling CSDs and energy drinks, with the company saying the brand is very popular with active Millennial women. The range focuses on fruity flavors and contains stevia.

Fit Soda

Functional benefits: Energy

Base: Carbonated water and flavor

Fit Soda, launched in 2018, comes across as more fun and indulgent range with the more traditional soda pop flavors. The range is formulated with branched-chain amino acids and electrolytes. It is sugar-free with zero calories and is popular with younger consumers. This brand announced a few weeks ago that it was extending this range to include hard seltzer as well.

These companies have shown that CSDs don’t have to be the same old sugary drinks, but can get fizzy with it and evolve into beverages that suit the functional needs of today’s and tomorrow’s consumers.

Leave a Reply